Nasheed Says Government Alone Cannot Resolve Maldives’ Debt Crisis

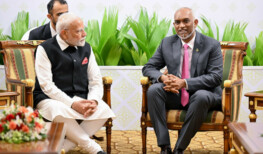

Nasheed says Maldives faces a debt trap and government cannot solve financial challenges alone | Photo: People’s Majlis

Former President Mohamed Nasheed has warned that the Maldives is deeply entangled in a debt trap and that the government alone cannot resolve the country’s growing financial crisis.

In a post shared on X, Nasheed said the state’s debt situation has become a national issue. He stated that the government is relying on new borrowing to repay existing loans, often at high interest rates, rather than addressing the underlying causes of the crisis. He said this approach demonstrates that the country is clearly caught in a debt trap.

Nasheed noted that the Maldives faces total debt obligations of USD 1.1 billion this year. He highlighted that a USD 500 million payment is due in April, an amount equivalent to more than MVR 15 billion. He said the government is attempting to raise funds through sukuk and bond issuances, including a MVR 2.4 billion bond arranged through the Pension Office to settle debts owed to private companies.

The bond transaction has led to a series of resignations at the Pension Office. Chairman Dr Ahmed Inaaz resigned on Sunday, following the earlier resignations of board member Saruvash Adam in October and Chief Financial Officer Hawwa Fajuwa on November 9.

Nasheed has previously raised concerns about the Maldives’ ability to attract investors. In September, he warned of a possible default, citing declining investor confidence. He has also repeatedly criticised China’s role in the Maldives’ foreign debt, stating that the country has been drawn into unsustainable borrowing.

International credit rating agencies have continued to assign a junk rating to the Maldives, limiting access to foreign financing. Opposition figures have questioned the government’s ability to refinance its obligations, particularly amid reports that Cargills may seek a USD 300 million loan at an interest rate of 15 percent.

Despite these concerns, President Dr Mohamed Muizzu has said the country’s debt obligations will be met on time. The government has not yet issued an official response regarding the high interest rates linked to recent borrowing efforts.